A property security line of credit (HELOC) try a form of capital enabling you to tap into your own home’s guarantee. Your own bank even offers a line of credit based on the amount away from guarantee you accumulated of your house, and you may continuously use using this harmony if you don’t visited new restrict.

HELOCs provide a blow several months, usually long-lasting ranging from five and you will ten years, where you normally withdraw cash from your personal line of credit. Specific HELOCs want notice and you may prominent repayments toward obligations during which mark period, while some only need interest repayments up until the mark several months comes to an end. A destination-merely HELOC can be advisable having people who require accessibility dollars and are also confident in their ability to settle the primary afterwards. Here’s everything you need to understand interest-just HELOCs.

What exactly is a destination-only HELOC?

A destination-merely HELOC is a type of loan you to merely demands desire repayments during the draw period. You can keep a continual equilibrium toward HELOC for the lifetime of brand new mark several months, and you might repay the primary which have appeal adopting the mark months closes.

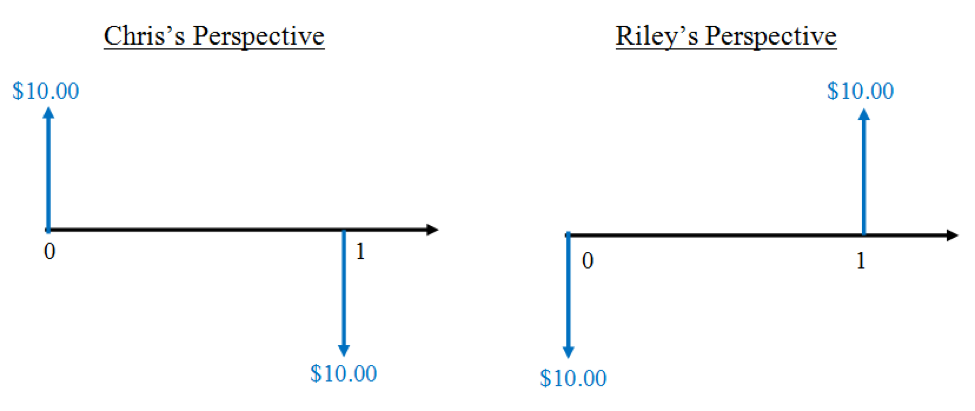

Really HELOCs keeps variable interest levels. Loan providers generally speaking promote a low interest early in the borrowed funds, however, after this introductory period ends up, your speed may begin to help you change. The interest rate may differ according to the market requirements and on their creditworthiness. As you only make focus payments through your mark months, their payment per month can alter drastically as your interest transform.

Their fee inside the mark months might increase if your HELOC balance increases. When you take out a lot more money from brand new line of credit, you are able to owe much more inside the focus even although you are not yet , trying to repay the primary. In the event you create additional money on the the principal, regardless of if, your monthly desire fee normally drop off.

Advantages and disadvantages of interest-only HELOCs

HELOCs normally promote competitive rates when comparing to their almost every other mortgage choices. When you yourself have enough guarantee of your house, a good HELOC is a superb treatment for availableness a large number of money.

The flexibility regarding an excellent HELOC is even desirable for many homeowners. While most types of finance render a lump-share payment, the HELOC is a credit line to borrow away from as needed. For example, you will get a good HELOC in 2010 to pay for your newborns university fees statement. If you like a primary household fix next season, you could borrow once again regarding the HELOC if you continue to have offered borrowing.

An appeal-just HELOC are going to be great in the 1st lifetime out-of the loan because you simply generate notice costs. not, this might really works against you by taking away a much bigger harmony than you can easily pay off. Since draw several months ends up, the monthly premiums will increase drastically.

Not being able to pay off their HELOC can also be place you inside a good serious financial predicament. Your property acts as shelter to the loan, so you could deal with foreclosures if you can’t build your money. Should you choose choose an attraction-just loan, it’s important that you plan in the future and ensure you could deal with the main and appeal payments.

A beneficial HELOC could possibly be the best selection for home owners who possess lots of security within property. If you’re there are many types of borrowing from the bank open to safety personal costs, HELOCs usually promote somewhat straight down rates of interest than personal loans or playing cards.

An effective HELOC is also good for consumers who have an effective percentage record and you can good 250 loan credit. The borrowed funds is secured by your house, you have to be positive about your capability to settle your debt. Loan providers tend to be very likely to accept candidates that a great lengthy credit history that have partners if any overlooked money.

An interest-merely HELOC is perfect for individuals which remember that they’ll be able to pay the main of your own financing when the day will come. Due to the fact mark several months is so lengthy, its about impractical to assume exacltly what the interest is in the event the draw months shuts. If you’re considering an attraction-just HELOC, just be entirely confident that you’re going to be when you look at the an economic condition to repay the bill if the draw period closes. For folks who assume any biggest life change, for example another child or advancing years, a great HELOC should be a risky selection.

Ideas on how to keep HELOC “appeal 100 % free”

It’s not necessary to reduce the primary harmony for the interest-merely mortgage up to adopting the draw period shuts. Nevertheless, possible place a king’s ransom towards desire for individuals who only build attract costs for a long time. You could potentially cut down on the quantity of interest your spend on your HELOC by paying from the dominant harmony due to the fact you choose to go.

Even though this actually necessary with an intention-merely HELOC, it’s the really cost-productive means when you can afford it. Actually paying a little part of the principal balance ahead of the termination of the latest mark period can aid in reducing their focus repayments.

Solutions to an effective HELOC

If you have felt like one a beneficial HELOC isn’t the proper option, you may have several similar selection which may be a far greater match. That common option is a home guarantee financing, that also makes you utilize your own home’s guarantee. An important difference in a HELOC and a property equity loan is that the house collateral financing try a single-big date percentage unlike a line of credit. Particular people prefer the simplicity and you may stability regarding a house guarantee loan more than a HELOC.

Another way to access your house guarantee are a finances-aside refinance. With a this sort of refinance, you could change your newest financial with a much bigger one to and you may receive the improvement just like the a swelling-share payment. In most cases, mortgage brokers allows you to acquire to 80% of residence’s really worth, very a money-aside family re-finance is an excellent option when you yourself have even more than 20% guarantee regarding the assets.

You can also choose for a the majority of-in-you to definitely home loan, and that serves as a variety of home financing, a checking account, and you may good HELOC. Having an almost all-in-you to definitely mortgage, your payments take place into the a savings account which means you have access to the cash when you require bucks. This program is perfect for people with good credit and you will a good strong borrowing record.

Interest-only HELOCs try a famous choice for individuals who possess built right up domestic guarantee and need entry to loans having significant costs. Paying back your debt was a long-identity relationship, though, it is therefore best for property owners who’ve an obvious attention away from their monetary future. You can weigh advantages and drawbacks and consult an American Funds home loan expert see whether a good HELOC ‘s the best one for you.