To see how much cash you’ll be able to pay monthly, multiply the new day-after-day rate from the amount of months on your charging duration. When you have a good twenty seven-day charging you cycle, proliferate 0.55 by twenty seven. Into a $1,000 harmony which have a good 20% Apr, you are able to spend $ in the desire monthly.

Variety of Apr

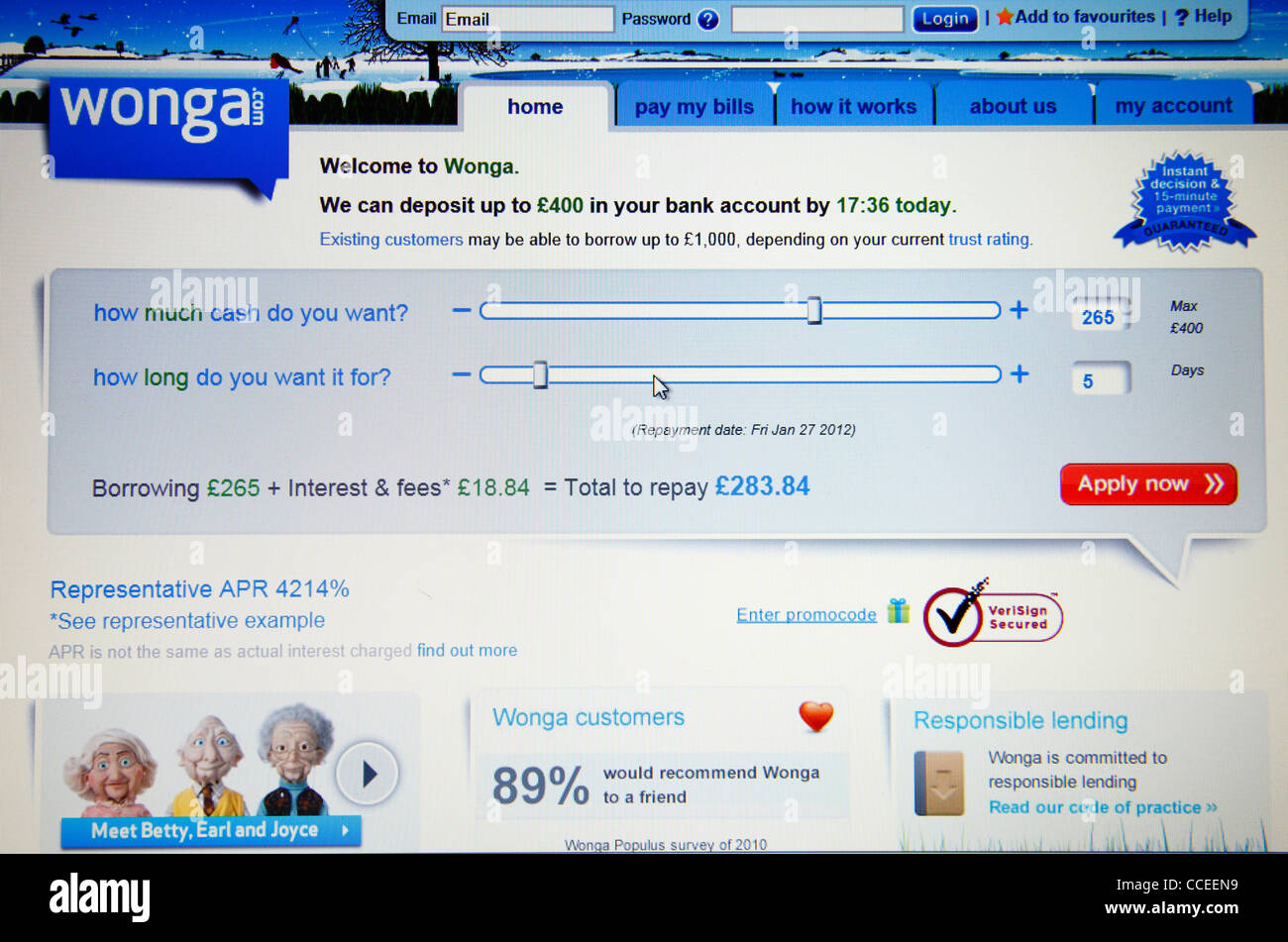

Your own mastercard may charge a new ple, particular credit cards possess a unique Annual percentage rate to possess transfers of balance, that can be higher or below the quality Apr. Brand new Annual percentage rate to the payday loans might be considerably higher than to possess basic cards commands. If you pay later or else violate the brand new regards to your own cards agreement, you may have to pay a punishment Annual percentage rate.

If you utilize your own credit card discover cash, you can easily generally spend another, higher Annual percentage rate that doesn’t features an elegance period.

You might transfer a balance in one credit to a different. When you do, you’ll constantly spend another ount. Specific notes provide a reduced Apr to have balance transfers to help you entice one option.

Playing cards possibly provide an advertising otherwise basic Annual percentage rate, eg 0%, so you’re able to encourage you to definitely open a different sort of account. The promotional speed get connect with new purchases on earliest few months otherwise seasons you have this new credit.

For folks who shell out later or skip a couple of costs, the card company may charge your a penalty Apr, that can easily be higher compared to pick Apr. (Setting-up recurring monthly obligations otherwise payment alert reminders can help you stop later money.)

Check out the conditions and terms closely whenever joining a beneficial the new charge card. The fresh card promote ought to include a table having prices and you may costs making it easy to see your Apr.

Apr against. APY

If you find yourself Apr is how far you borrowed towards the a balance, yearly percentage yield (APY) describes how much cash an interest-results account, such as for instance a family savings, is earn yearly.

APY is additionally expressed as the a percentage and you may includes the eye rates toward an account, including how frequently desire compounds into membership. As you want an annual percentage rate becoming as low as you’ll be able to, you would like an APY to get as much as it is possible to, whilst makes it possible to generate income.

Credit card companies generally speaking bring better costs to people with high fico scores. Make money timely and avoid beginning several membership at a time to help keep your get popular upward. While you are behind toward any playing cards otherwise finance, rating newest on your repayments to improve your get.

Credit enterprises sometimes bring marketing equilibrium import APRs in order to encourage some one to open the fresh notes. For many who carry a balance towards the a credit with high Annual percentage rate, it could be convenient to open an equilibrium transfer credit and you get a loan Sunshine CO will gain benefit from the down rate.

Cannot hold a balance If you don’t have an equilibrium towards the your bank card, you will never shell out attention. Maybe not holding an equilibrium would not reduce steadily the Apr alone, however it will reduce how much you pay.

The bottom line into Annual percentage rate

Just like any economic arrangement, analyze your own borrowing card’s small print, including their APRs. Just remember that , Apr is only applied if you’re carrying an excellent harmony on your cards. You can generally stop spending one notice charge for people who spend regarding your card harmony before statement several months finishes each month.

Selecting the right charge card must not be complicated. Know about our mastercard solutions as well as how we’re in a position so you can achieve your money requires. If or not we should generate income back rewards or transfer a equilibrium, find the credit that will suit your existence and requirements.

- Proliferate the fresh new day-after-day price from the equilibrium you borrowed from: 0.0548% x step one,000. You will get 0.548, or about 55 cents on a daily basis.