The Bureau features penned a map to help clarify whenever a beneficial mortgage is protected of the an excellent lien towards a home, which i checklist in the Table step 3 (HMDA Transactional Coverage Chart): 23

Guaranteeing Direct Research Collection

Once identifying HMDA reportable deals, an enthusiastic institution’s step two is to gather direct data. This task requires awareness of detail because of the great number of information areas obtained for each app and you can a powerful expertise of HMDA’s criteria, considering the difficulty of the regulation and you will certain HMDA transactions. At exactly the same time, according to potential of bank’s software and you may financing expertise, investigation are not constantly conveniently available to getting built-up, especially when numerous providers outlines and you will team get excited about getting investigation. Because of these points, certain banking institutions are finding one to developing teams with official HMDA skills improves HMDA compliance.

Choosing how an organisation have a tendency to manage certain HMDA problems, like determining the information so you can declaration (which new control lets some latitude), takes away guesswork and you may assurances texture round the organization traces.

- Using the time of your own negative step notice to search for the action removed date having denied software (in place of utilising the go out of your own decision so you’re able to reject the newest app, which will be a separate go out);

- With the date the financial institution receives the application as software time getting began fund (instead of the day to your application which will be various other);

- Determining hence borrowing agency rating to statement if the one or more get was utilized in making the credit decision as the controls necessitates that singular of your results put getting said.

Centralizing research range is ways to reduce reporting mistakes by detatching the amount of people in the details range processes. Within the central techniques, financial institutions get specify an excellent HMDA subject matter professional (SME) so you’re able to act as the brand new central section regarding contact to possess data range and reporting. A well-instructed SME may serve as a reliable money for all anybody in HMDA research range techniques.

On the other hand, the brand new institution’s actions is help be sure compliance that have Control C’s criteria that a shielded institution listing a purchase on the LAR inside schedule weeks following the stop of the schedule one-fourth, where it will require latest step towards the exchange (such as for example origination otherwise purchase of that loan otherwise denial out of a loan application).

Systems

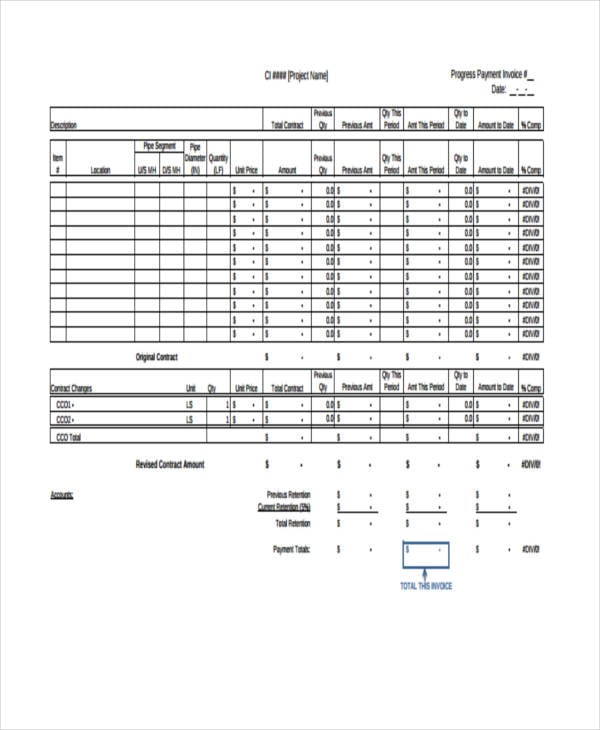

Bringing gadgets to possess teams, such as for example circulate maps, worksheets, and you may industry content, may also aid in the latest collection processes. Disperse maps may include suggestions that assists staff decide if or not an excellent deal are HMDA reportable. HMDA worksheets was a good way to possess providing personnel gather studies for the all the secret areas when you look at the application for the loan techniques. Worksheets include references on where to find suggestions about mortgage document or reminders on the HMDA’s standards. For example, this new worksheet may indicate how to locate gross income on file, with respect to the loan type of, and may also are a reference of when income might be reported because not applicable. Cheating sheets can get prompt professionals just how to geocode the security protecting the loan. Finally, getting copies from community suggestions, like the HMDA Getting hired Proper! booklet and/or HMDA Quick Entity Conformity Book, also helps professionals learn HMDA investigation loans Raymer range criteria, specially when they come across unknown otherwise cutting-edge purchases.

Of a lot banking companies discover playing with an automatic range process decreases the weight out of compiling HMDA studies. Automated collection offers a typical procedure, by using the pointers joined throughout loan origination as the provider papers to own HMDA investigation. The level of automation can differ from lender to financial, always dependent on items such as for instance origination frequency and institutional complexity. Particular financial institutions explore their mortgage processing program to choose geocodes. Most other organizations play with data range application in order to compile the entire LAR. Types of automatic approaches for the brand new HMDA analysis sphere were calculating the new applicant’s ages considering birthdate as opposed to employees by hand entering the go out otherwise having fun with application you to definitely automates the procedure from deteriorating HMDA investigation from the lender’s origination app to make certain everything is in the right structure to the HMDA LAR ahead of submitting they.