What’s a debt settlement mortgage?

A debt negotiation loan was an unsecured consumer loan which you pull out in order to consolidate numerous lines of credit card personal debt and/and other expenses with a high rates of interest towards the a single loan, preferably having a lesser rates.

A consumer loan having debt consolidating is actually a sensible technique for reducing personal debt, spending less, and you may simplifying your lifetime. Expenses during the numerous places can lead to concerns and worry. Should you get a reduced interest financing to have debts that have large attention, you might spend less on the speed. And, handmade cards will often have sky-highest APRs, which is no good regarding financial health and wellbeing institution. When you have multiple bank card expense, it is always smart to discuss what kind of coupons you https://paydayloancolorado.net/antonito/ may get with that loan to settle borrowing notes.

How come a debt negotiation financing works? Are debt consolidation smart?

Debt consolidation is the process of using an unsecured loan in order to repay numerous personal lines of credit financial obligation and you can/or other debts. Debt consolidation is sensible in case the mediocre interest speed all over any lines of credit and you may/or any other debts exceeds what your personal bank loan focus price would-be.

An educated debt consolidation reduction financing security the quantity of every of your mutual loans to pay-off their some other debts upfront, causing you to be which have one simple monthly payment. The Annual percentage rate into a personal bank loan to own debt consolidation can be lower than that of their past individual expenses hence rate is repaired-maybe not changeable. Thus, since you pay-off your loan to own debt consolidating, you pay a good cumulatively all the way down number of interest than simply you’d enjoys for people who had not consolidated your debt.

An unsecured loan getting credit card debt combination means that build singular payment per month. Enabling you to package and you can budget your life with more clarity and you will ease. That loan as a consequence of Do just fine is additionally one of the finest possibilities to own debt consolidating as you will has customized support to your label. Prosper provides Customer support Advisers who have the options to help with your at each step of method, and a purpose to advance your financial well-getting.

Do debt consolidation reduction loans harm your credit?

Your credit score could possibly get miss quite directly once you combine obligations. Over time, yet not, a responsible monetary approach on the debt consolidation can be change your score.

You will find several prospective quick-label has an effect on toward credit profile that will trigger your own score becoming some lower very first through to combining debt which have a keen unsecured personal loan.

- Getting a personal loan for debt consolidation reduction will demand a challenging inquiry into your credit rating. This may possibly briefly lower your score.

- Paying their borrowing from the bank and you will/or obligations outlines have a tendency to decrease the personal debt you owe and lower your own credit usage proportion (and/or amount of all your stability split from the contribution of one’s cards’ borrowing from the bank limits)-an option factor that influences your credit rating. However, a personal bank loan is yet another debt, and incorporating a unique financial obligation you may temporarily reduce your credit rating.

Everything you would just after combining that may figure just how the get changes a lot of time-identity. Like, for individuals who reduce the credit debt which have a consolidation financing but always accrue personal credit card debt, the latest ensuing cumulative loans will likely provides a terrible credit impact.

Would debt consolidation loans assist their credit?

Merging personal credit card debt having a personal loan may help their credit of the lowering your charge card stability and you can starting increased ratio off readily available borrowing (or how much cash of your own readily available borrowing you will be having fun with)-yet another factor that affects fico scores.

A proactive method of debt consolidation might help boost credit. That it involves an extended-label strategy and a huge visualize goal of increased total monetary wellness. Repaying multiple lines of credit and/or obligations having fun with an unsecured unsecured loan that have a diminished rate can aid in reducing your debt and lower your own borrowing from the bank utilization ratio (and/or sum of all of your current balances divided from the sum of your cards’ borrowing from the bank restrictions)-important aspects which affect your credit score. Purchasing shorter during the desire may also help decrease your monthly installments.

And come up with with the-time payments toward credit cards or any other expenses is essential. A lengthy reputation for constantly making costs on the-big date is good for your credit rating. Debt consolidating financing is very theraputic for their credit reputation and your credit score, however, only when used given that a long-term strategy for economic growth done with mindful abuse.

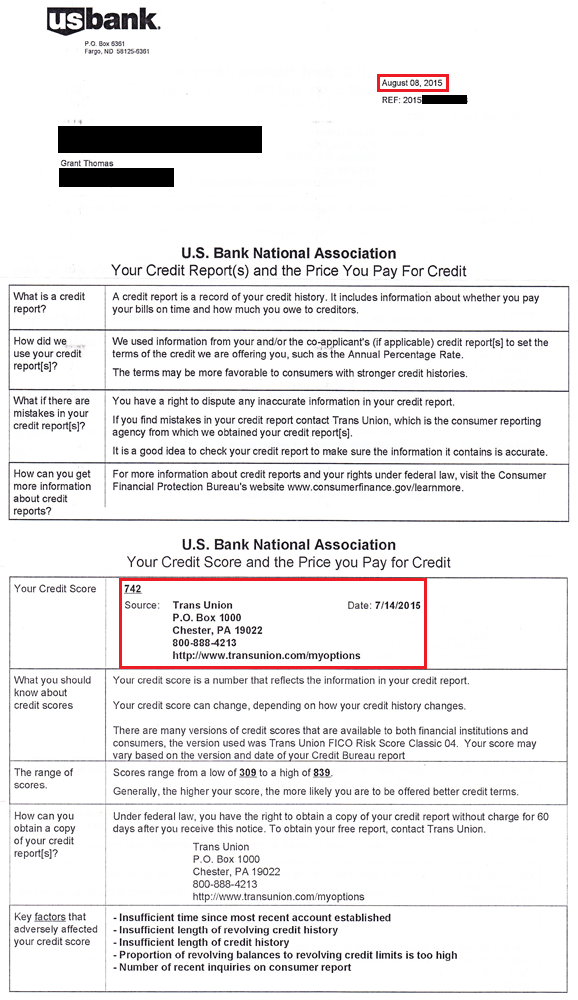

Would debt consolidation funds apply at purchasing a property?

Even though debt consolidation reduction funds apply to what you can do to invest in a house relies on your schedule to make your purchase.

Its generally not recommended to incorporate people the newest bills or and also make inquiries on the borrowing reputation before buying a property.

That being said, if you are planning to acquire a home within the a-year otherwise way more, merging your own credit card debt now as the a strategy to boost your debts you can expect to place you in a updates when enough time involves submit an application for a mortgage.

Sooner, when you attempted to purchase a property we wish to make sure to has actually smaller your general loans doing it is possible to and possess spent some time working to improve your credit rating as much as you’re able to.