Contents:

To the point explanation about the pattern like how to trade inside bar pattern and if there is any whipsaw use it in your favor and other important points. You can enter using a stop order when the price breaks out of the Inside Bar. So, you go long when the price breaks above the highs of the Inside Bar. So, when the price “stalls” after a pullback , you want to enter as soon as the price resumes in the direction of the trend.

Kelsey Grammer Set To Pour Brews, Greet Fans At Brick Pub – Patch

Kelsey Grammer Set To Pour Brews, Greet Fans At Brick Pub.

Posted: Mon, 29 Aug 2022 07:00:00 GMT [source]

Then, traders would look to go short on the break of the Inside Bar. That’s not smart because it’s a low probability trade especially when the market is in a “choppy” range. Many traders would spot an Inside Bar and they’ll trade the breakout of it. The inside day with narrow range is an inside candle which also has the smallest day range among the last four days. This indicates that the range is shrinking and is due for a volatility expansion. When we short the EUR/USD, we would want to place a stop loss order above the upper level of the inside range.

Fakey Trading Strategy (Inside Bar False Break Out)

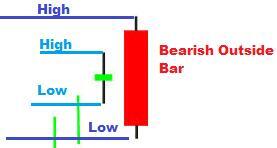

This could give you a tighter stop loss and a bigger potential reward. The outside bar pattern can “trick” traders to enter trades when the support or resistance level is broken. Once the trader sees the reversal pattern take shape, they exit their trades causing price to move rapidly in the other direction.

The outside bar candlestick pattern can also be used to trade trend continuations. This happens when the trend bias of the engulfing candlestick correlates with the trend the price is currently on. For instance, a bearish outside bar pattern appearing on a bearish trend is suggesting that the bearish trend continues.

When using a confirmation entry you are waiting for price to break the high or the low and then entering. For example, if you are looking to enter a bearish outside bar you would be waiting for price to move below the low of the outside bar before then entering. You could use a pending sell stop order so you don’t have to actually watch and wait for price to make this move. In the example below, price moves higher into a swing high that is also a key resistance level before forming a quality outside bar. This outside bar opened down, buyers stepped in setting up a reversal, stops were hit and then selling took over taking out the other side of the past several days.

Sometimes, the opening price of the bullish candlestick is lower than that of the previous bearish candlestick. In some other cases, the opening prices of the two candlesticks are at the same level. Traditional technical analysis teaches that outside bars are setup bars for a breakout in either direction, and that you should put an entry stop above and below. Once filled, double the size of the unfilled stop and make it a reversal order. However, it is almost always unwise to enter on a breakout of a 5 minute outside bar, especially if the outside bar is large, because of the greater risk that the distant stop entails. Sometimes they occur when you are looking for a major reversal and you are very confident that there will be a large, strong reversal.

How to Trade with Candlestick Charts

The outside bar trading want a reversal down, even if there is first a breakout above the monthly OO pattern. Most prior bear bars in buy climaxes on the monthly chart led to a 2nd bear bar within a bar or two. That means the bears hope that November rallies and then reverses down at the end of the month to close below the open of the month. However, 2020 broke strongly above the June 10, 2020 and the March 9, 2020 highs.

US adds two dozen Chinese groups to trade blacklist – Financial Times

US adds two dozen Chinese groups to trade blacklist.

Posted: Thu, 02 Mar 2023 08:00:00 GMT [source]

The bullish outside bar pattern appearing on a major uptrend suggest a trend continuation on the uptrend. Also, the pattern appearing right after the breakout from the minor downtrend further suggest a trend continuation. There are two major ways to trade the outside bar candlestick pattern. The first one is reversal trading, and the other one is trend continuation trading. Oreoluwa Fakolujo Forex Trader & Writer One of the most commonly used among them is the outside bar candlestick pattern.

Identifying Potential Outside Bar Trading Signals

You can place your stop loss below the opening price of the engulfing candlestick for a bullish scenario. But we recommend doing so while using the Stop Loss Clusters indicator. This indicator shows you where the stop losses of most traders have clustered. The big banks and other forex whales often force the price to temporarily fall to these stop-loss levels to take out the stop losses of retail traders. So you can use the indicator to plan your stop losses properly.

Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. This website is free for you to use but we may receive a commission from the companies we feature on this site. To clarify, bar range refers to the difference between the high and the low of a bar. An inside bar must stay completely within the range of the bar immediately before it. In other words, the second bar must have a lower high and a higher low. We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading.

The Weekly S&P500 Emini futures chart

The trading room is for educational purposes only and opinions expressed are those of the presenter only. All trades presented should be considered hypothetical and should not be expected to be replicated in a live trading account. The bears want a reversal down from a higher high major trend reversal and an expanding triangle top . Friday made another new all-time high and it was another bull bar closing near its high. This week’s Emini weekly candlestick was the 4th consecutive bull bar, and it closed at new high. Three sideways bars are often a magnet, which tends to draw the market back to it after a breakout.

It’s essential to use your judgment and consider other factors such as the overall market sentiment, upcoming economic events, and the risk-reward ratio of the potential trade. Keep in mind; this is a reversal signal so it is very important where you play this candlestick trade from. Just as the example shows below, with a bearish outside bar you need to be finding them up at swing highs. Shane his trading journey in 2005, became a Netpicks customer in 2008 needing structure in his trading approach.

Since Friday closed near the high, Monday could gap up to a new all-time high. For now, the odds favor at least slightly higher prices in November. However, there is always a bear case, and a 40% chance of it happening.

- But it also means there’s less likelihood of getting stopped out too early in the trade, i.e., it can give the trade more breathing room.

- Three outside up/down are patterns of three candlesticks on indicator charts that often signal a reversal in trend.

- Shane his trading journey in 2005, became a Netpicks customer in 2008 needing structure in his trading approach.

- You can use one, two, or three times the size of the pin bar to determine the target.

- There is always at least a 40% chance that the opposite of what is likely will happen.

And any trader, regardless of their trading style, can take advantage of and incorporate these patterns into their trading methodology. Use a multiple of the size of the pin bar as a target, or apply simple price action rules in order to exit the trade. Open a trade in the direction of the pin bar when a candle closes beyond the smaller wick of the pattern. You now have some ideas on how to enter the market on pin bars and where to put your stop loss. So the next logical question becomes “Where should we exit our trade”. As with every other trade setup, you should never be unprotected during your trade.

It’s yours, free.

Conservative traders should consider buying the EUR/USD when the price action closes the next candle above the upper level of the range. Aggressive breakout traders would consider buying when the price reaches a few pips above the inside candle high. In either case, your stop should be located below the bottom of the range as shown on the image.

Step Inside Z Bar Trading Company, a 30000-Square-Foot … – Texas Monthly

Step Inside Z Bar Trading Company, a 30000-Square-Foot ….

Posted: Tue, 19 Apr 2022 07:00:00 GMT [source]

Since most trading range breakouts fail, this selloff will probably be simply a test of those two support levels. I trade the major Forex pairs, some Futures contracts, and I rely entirely on Technical Analysis to place my trades. I began trading the markets in the early 1990s, at the age of sixteen. I had a few hundred British pounds saved up , with which I was able to open a small account with some help from my Dad. I started my trading journey by buying UK equities that I had read about in the business sections of newspapers.

This means if you set your stop loss just below the lows of the Inside Bar, you could get stopped out prematurely on a Bullish Hikkake Pattern. When it comes to stop loss, you don’t want to set it just beyond the lows of the Inside Bar. Now, I’ve covered a lot about Inside Bar trading strategies and techniques. But the next thing you know, the market does a 180-degree reversal and collapse lower — and you’re sitting in the red.

Many traders consider this as one of the most powerful candlestick patterns for trading. So today’s discussion will be dedicated entirely to the pin bar reversal candle. If a long entry is taken on the bullish outside candlestick pattern the stop loss could be on a close below the lows of the large candle.

The area between the open and close of the pin bar is called its “real body”, and pin bars generally have small real bodies in comparison to their long tails. In the example below, we are looking at trading an inside bar pattern against the dominant daily chart trend. In this case, price had come back down to test a key support level , formed a pin bar reversal at that support, followed by an inside bar reversal. Note the strong push higher that unfolded following this inside bar setup.

High-quality Outside Bars will notice you of strong dominance of bulls or bears, and therefore it is usually the best to be on the same side of the market. The Outside Bars are based on a simple price action and thus are relatively easy to understand. This means both novice and expert traders can make the most of it.

Let us look at actual examples of https://forexhero.info/ bar patterns on charts. If this is your first time looking at this pattern, you’ll find it very easy to spot after seeing just a few real examples. Although this technically falls under the definition of a bullish Engulfing pattern, I do not consider it a powerful setup. The wicks are long on each candlestick, suggesting indecision, and the second candlestick closed far lower than its high, which is not a particularly bullish sign. I’ve used this pattern for over a decade across many markets—Forex, equity indexes, metals, and Crypto. It is easy to spot on a chart, and the rules are straightforward, making it a simple pattern to trade.