Homeowners have access to a key weapon that build an improvement on the profit hence, life: equity.

“Security can make a significant difference so you’re able to another person’s lives and you may monetary outlook, as the so much more security some one enjoys, more currency they might possibly have access to,” says Jospeh Daoud, mortgage broker and you may Chief executive officer regarding It’s Effortless Loans.

Equity ‘s the difference in a great home’s latest value and you may one financial obligation however to-be paid into mortgage. Such as for instance, if the house is well worth $one million plus mortgage are $700,000, you’ve got $3 hundred,000 inside equity. Should your property value upcoming grows so you can $step 1.1 million but you in addition to paid down $100,000 out-of your loan, the collateral is becoming $five-hundred,000.

However, which guarantee shall be utilized of the promoting, but people who like to maintain their residence can remain their resource and employ brand new equity to cover large-solution circumstances, along with a secondary otherwise their second assets.

Security 101

“Using your guarantee is largely letting the LVR work for you,” claims Daoud. LVR try yourloan-to-value proportion, the quantity you will want to obtain out-of a loan provider.

“Including, if someone in past times purchased a home, getting $500,000 and their financing is actually to possess $400,000, their LVR try 80 %. It is harder to utilize this equity since you have discover a lender that will allow you to obtain more than 80 per cent instead of running into lenders financial insurance costs (LMI),” the guy demonstrates to you.

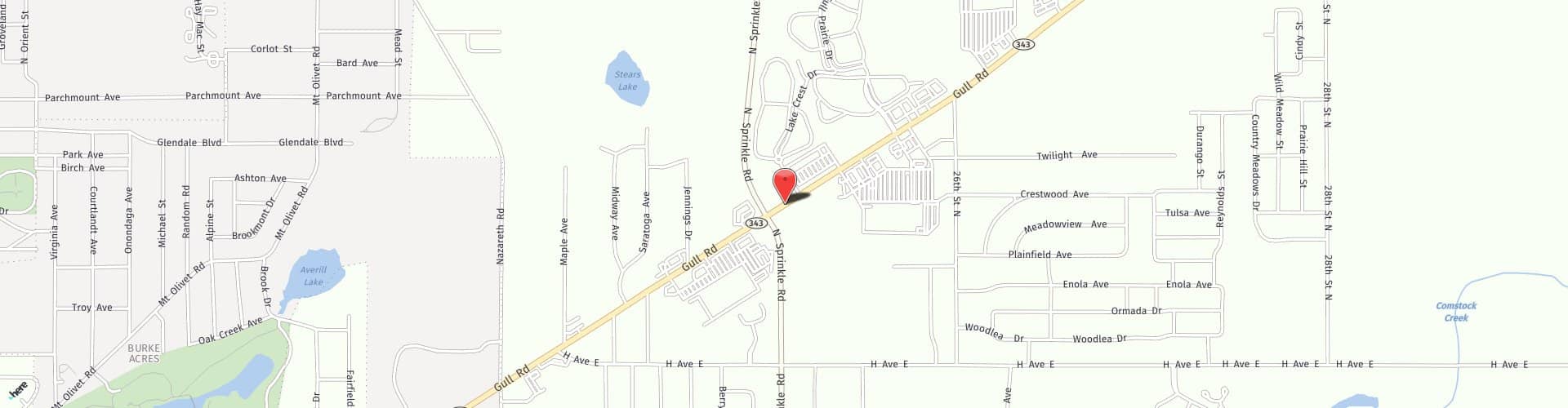

Possessions Listings

Accessing the latest guarantee is actually requesting a special loan and you will getting towards the more personal debt, so the bank often measure the exposure think its great performed when you taken out your first mortgage.

A top LVR poses far more exposure toward bank, that is the reason LMI is sometimes instated in the event the LVR is actually 80 % or even more, or for those who have below 20 percent of your own put.

” not, should your property has grown off $five hundred,000 in order to $600,000 (hence we seen many within the last seasons) along with your mortgage provides diminished from $eight hundred,000 to help you $350,000, then you’re able to draw one to 80 per cent,” shows you Daoud.

Eighty % regarding $600,000 is actually $480 000. When you deduct the modern mortgage sized $350,000, you to makes your which have $130,000 regarding useable collateral.

How much cash security normally a property owner supply?

step 1. Struggling to make additional repayments2. Utilizing the guarantee getting something that the financial institution cannot get a hold of complement,” says Daoud.

“Instance, for folks who individual good $five hundred,000 possessions also it thus goes wrong with increase so you’re able to $step one.5 million, you may have managed to services the prior $400,000 financing, nevertheless ount your seeking getting.”

Daoud and contours that reason for accessing security plays an excellent role, with banking institutions looking unfavourably on the overdue credit debt, a tax debt otherwise accountability, or any other things like deluxe otherwise creator issues. Read: lender’s try not to like initiating finance in the place of compatible excuse.

Certain lenders get allow you to use as much as 90 percent of the property’s worth based their criteria and you will purpose, but with the debt growing and this payments set-to go up, it is necessary to not talk about 70 %.

Exactly what huge-solution issues is also security be used to possess?

“You might make use of equity purchasing larger-citation situations, such yet another possessions otherwise a vehicle otherwise a boat,” demonstrates to you Daoud.

“The method that you do this is actually either through a guarantee launch or refinancing, any type of is most effective for the situation.”

Situations tend to be:

1. Renovations (one another structural and beauty products however, large-measure architectural renovations will likely need a housing mortgage)2. Acquisition of upcoming opportunities (whether it is offers or other property)3. Purchase of a holiday home4. Acquisition of a vehicle or boat5. Percentage out of a secondary otherwise wedding6. To settle small-name obligations including: car loans, personal loans, playing cards (for as long as there aren’t any dishonours) and HECS loans

Security might be a smart way to create your possessions money collection, once the you will be essentially leveraging the development on your earliest home to money a deposit for the next house. As the property value payday loan fast North Carolina the next assets increases, you will be able to wash and you will do this again.

“You might tap into equity to reach their 20 percent put and be able to get alot more property down the road,” claims Daoud. It means you can make your future flow without using the own private dollars savings.

“You are able to the newest leasing money to assist in settling the borrowed funds, while necessary, you can utilize bad gearing to assist in offsetting income tax. You could potentially reuse this action the higher the portfolio becomes in order to be able to pick far more qualities down-the-line.”

If this is things you are searching to-do, it is essential you engage an experienced and you may qualified agent that have individual expertise in resource features.

“The brand new character of the representative should be to make sure to can still solution these home loans whenever you are proceeded to live your perfect lives instead of damaging the financial,” contributes Daoud.

It is also crucial that you just remember that , this strategy depends on value of expanding, which is never ever guaranteed. Coping with a monetary elite allows you to see and you may end up being confident with any exposure inside it.

All the info offered on this site is actually general in general merely and does not create private monetary recommendations. The information might have been waiting instead considering your own expectations, financial situation otherwise needs. Just before functioning on people information on this web site you have to know the appropriateness of your own recommendations that have reference to their expectations, finances and requirements.

- Finance

- Qualified advice

- Financial

- Lenders

- Explainer

- Send